Another important feature of our Treasury Platform is that it has a built-in Index forecasting capability. Through a simple user interface, the user can forecast future indices and yield curves based on historical correlations. The algorithms make use of advanced forecasting models and statistical methods to create these forecasts in an easy to use manner.

Forecasting

The user imports a selection of interest rates (bank rate, LIBOR rate etc), indices (oil price, inflation rate, etc) and yield curves (Treasury bills, Government bonds, etc) and selects one that they believe to be a prominent driver in the economy. The system programmatically correlates the rates, rejecting any rates that fall below a user-defined threshold.

Yield Curve

There is a selection of five different forecasting methods to choose from. Detailed knowledge of statistics is not required as there is an option for the system to select the best suited method for the given data set. Given a user’s forecast of the driving rate the system computes the forecast for all other imported rates. In the forecast procedure the system considers the fact that rates do not always react in the same time period – a shift in one rate this month may only reflect on another rate in 3 months as the market takes time to adjust – and so the forecasts are adjusted according to the leads or lags in the rates. The system can also convert different maturity bands into yield curves for that edge when examining market trends.

Monte Carlo

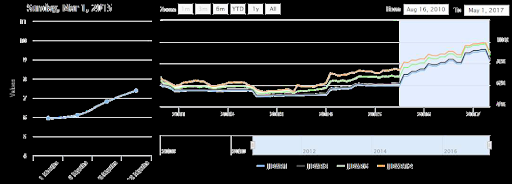

Beyond straight forecasting the system can be used to generate Monte Carlo scenarios, but what makes the system stand out is that the Monte Carlo generations are not simply a randomisation of market rates but uphold certain relationships. For example, if two rates have maintained a spread of 350 bps over the last ten years, then it is impractical for scenario planning to allow these rates to randomly deviate from one another. Thus, the Monte Carlo scenarios are generated in such a way that the user is never left basing decisions on unrealistic forecasts.

Monte Carlo Display

All rate views and Monte Carlos are viewed through a sleek and interactive graphing system that brings your data to life. For advanced users, there are user-definable parameters to customise forecasts e.g. by specifying random walk step size, number of sub-correlations and other model-specific variables.